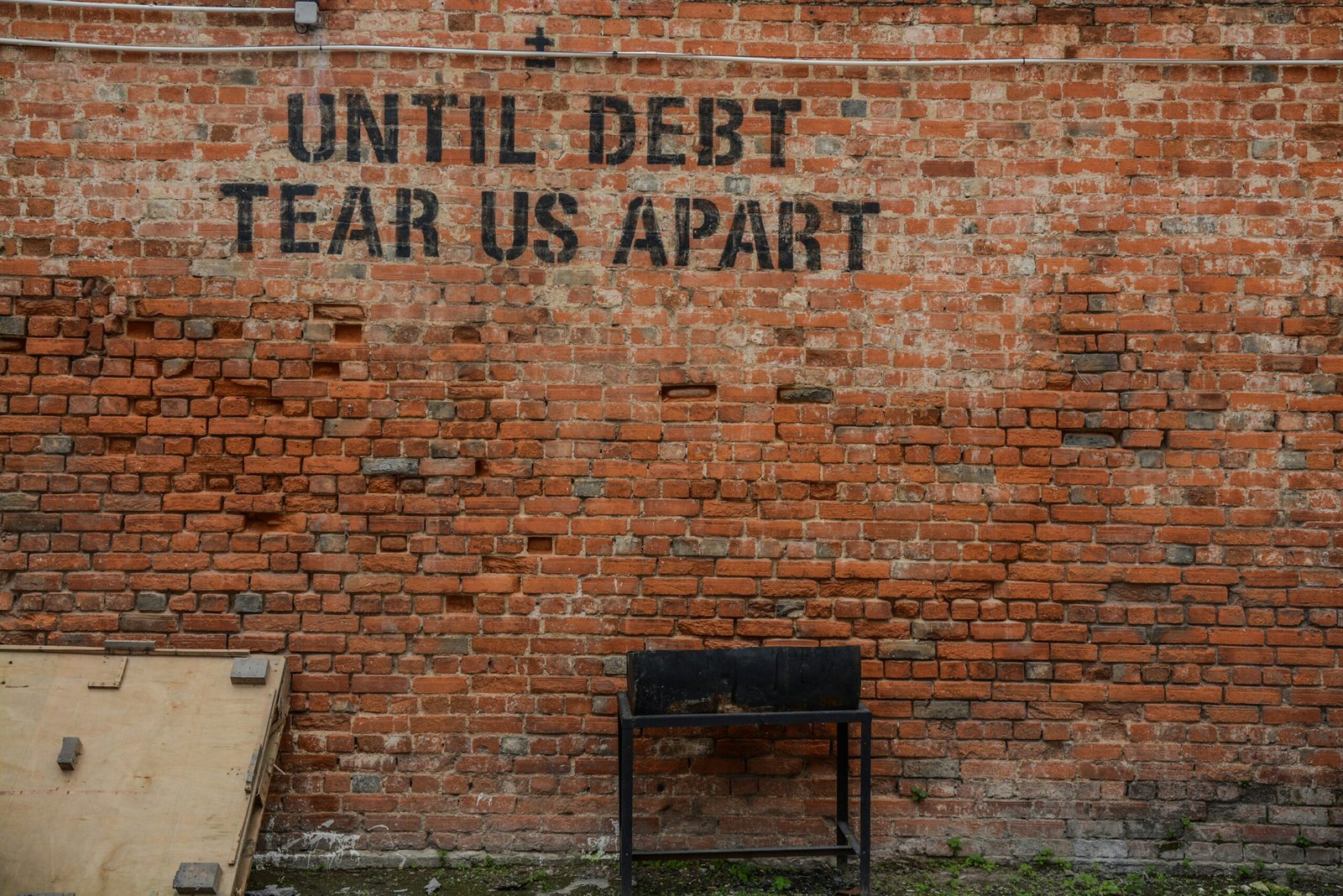

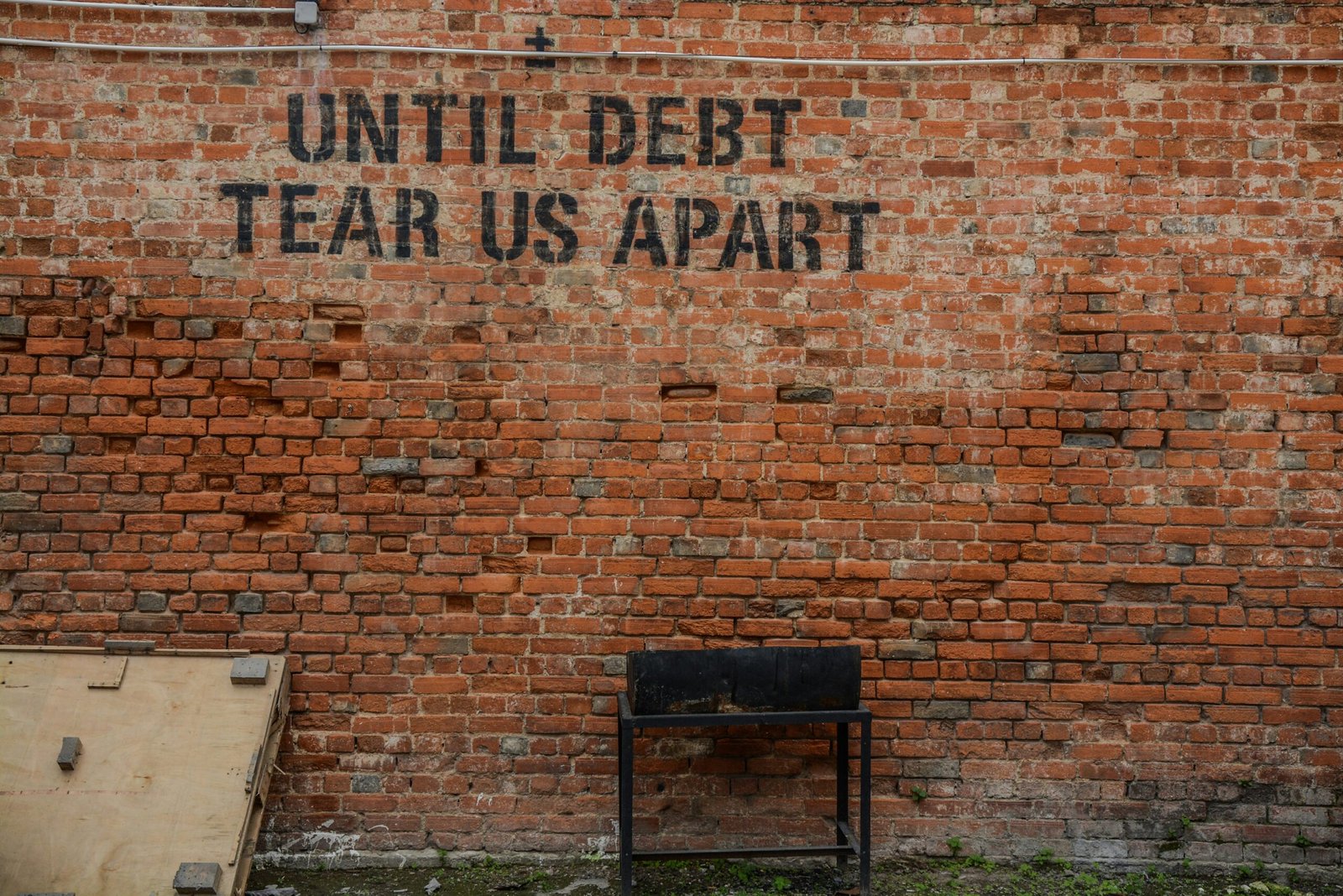

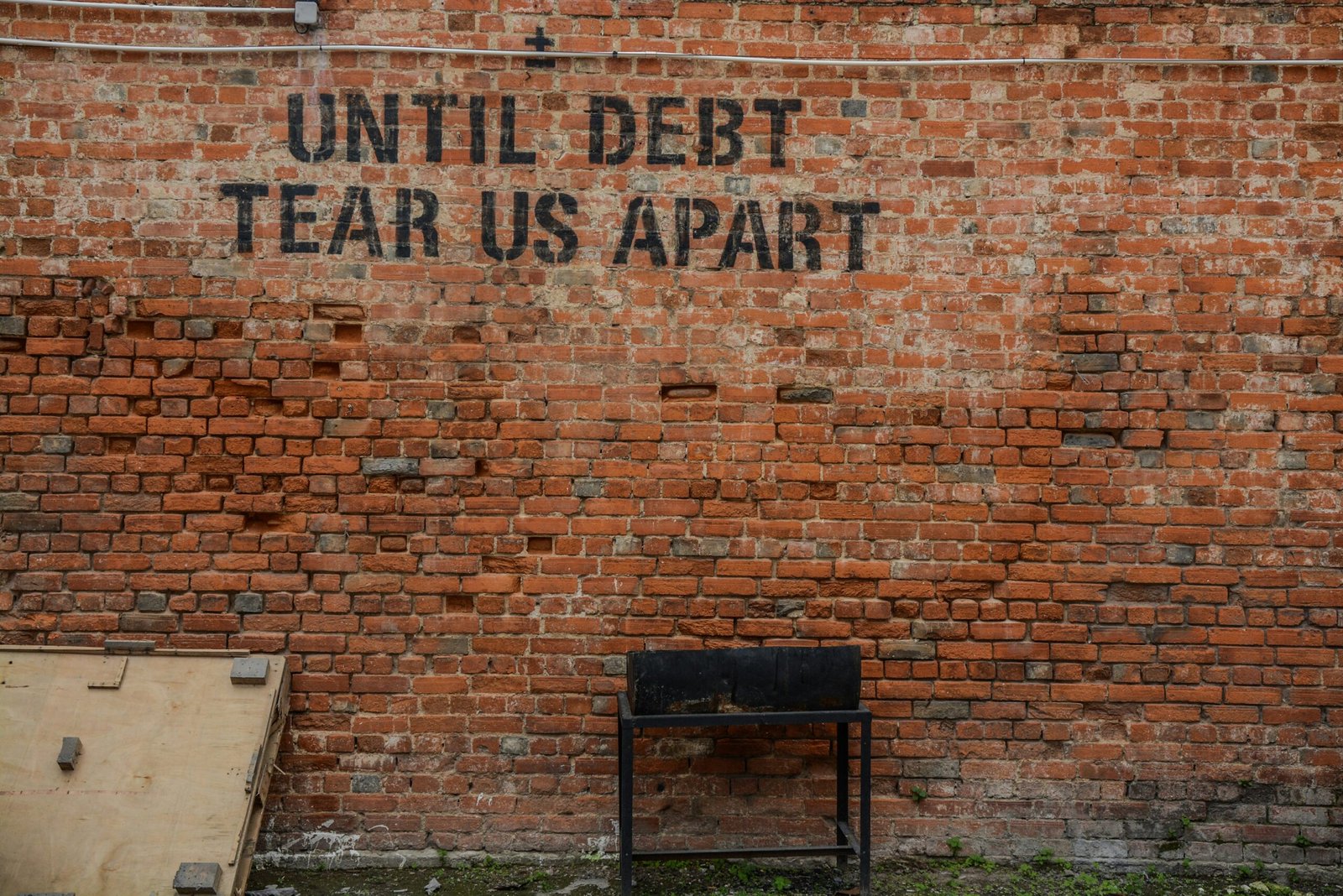

The Debt Payoff Challenge: An Introduction

The Debt Payoff Challenge is a structured initiative designed to empower individuals to take control of their financial futures by systematically eliminating debt within a concise 30-day timeframe. This engaging challenge is distinct from traditional debt repayment methods, focusing not only on the mechanics of paying off debt but also integrating psychological aspects that encourage sustainable behavioral changes. By addressing the mindset surrounding debt, participants can harness motivation and accountability, transforming their approach to finances.

The enhancement to financial wellbeing achieved through the Debt Payoff Challenge stems from its innovative design. Unlike conventional strategies that may feel overwhelming and burdensome, this challenge promotes a realistic and achievable path toward financial freedom. Participants are often surprised by their ability to make a substantial dent in their debt in just one month. Some of the core structural elements of the challenge include daily actionable tasks, regular progress tracking, and opportunities for community support through shared experiences. Together, these components create an environment conducive to success.

One hallmark metric of the Debt Payoff Challenge is the average debt eliminated over the course of the program. Participants have reported reductions in their debts ranging from several hundred to several thousand dollars. Additionally, success rates tend to be significantly higher than traditional methods, as the framework encourages continual engagement and focus on progress. Encouraging participants to reflect on their habits fosters a culture of financial literacy and responsibility. Ultimately, the challenge not only aims to help individuals eliminate debt but also instills a proactive mindset aimed at long-term financial stability. This makes the Debt Payoff Challenge an invaluable undertaking for anyone looking to improve their financial circumstances.

Weekly Breakdown of the 30-Day Challenge

The Debt Payoff Challenge is structured over four weeks, each designed to address distinct aspects of financial management and debt elimination. This comprehensive breakdown ensures participants can focus on significant improvement while maintaining a sustainable approach towards their financial obligations.

In the first week, the foundation is laid for a successful debt payoff journey. Participants will engage in activities to assess their current financial situation, including tracking income and expenses, calculating total debt, and identifying unnecessary expenditures. The goal is to create a detailed budget that highlights areas where participants can cut costs. They will also explore the importance of budgeting tools and set actionable tasks for the week to establish a strong grounding for subsequent phases.

Transitioning into Week 2, the emphasis shifts towards acceleration strategies. Here, participants will learn about various debt repayment methods, such as the snowball and avalanche techniques. Daily tasks include prioritizing debts based on interest rates or balances and implementing automated payment systems to stay organized. This week aims to instill a proactive mindset, pushing participants to make additional payments towards the principal amount, thereby accelerating their debt repayment journey.

During the third week, mastery implementation is the focus. Participants will refine their strategies, evaluating their progress against established goals. They will examine their budgeting effectiveness, assess unexpected expenses, and realign their repayment tactics as needed. The week includes daily reflection activities to track success and adjust plans accordingly. A mastery of their budget permits participants to better tailor their efforts towards achieving financial freedom.

Finally, Week 4 is dedicated to future-proofing financial success. In this concluding week, participants will develop strategies to sustain financial health post-debt elimination. They will explore savings plans, emergency funds, and investment opportunities, ensuring they build lasting wealth. Daily tasks include setting long-term financial goals and creating a roadmap for maintaining financial discipline beyond the challenge. Overall, this structured approach equips individuals with essential skills and knowledge for ongoing financial wellness.

Real-Life Success Stories and Metrics

The Debt Payoff Challenge has fostered inspiring transformations for numerous participants, showcasing the positive impact of committed financial discipline. One noteworthy testimonial comes from Amanda, a participant who successfully eliminated $15,000 in credit card debt within the 30-day period. Amanda attributes her success to the structured nature of the challenge, which provided her with the accountability and resources needed to stay focused on her goal. Her journey illuminated the power of budgeting and prioritizing payments, and she now advocates for others to embrace similar initiatives.

Another compelling story is shared by John, who managed to reduce his interest rates on existing loans by an impressive 5%. By utilizing the techniques learned during the challenge, he promptly contacted his lenders, armed with knowledge about competitive rates and statistics. His methodical approach not only relieved his financial burden but also equipped him with the confidence to negotiate better terms in the future.

Metrics reinforce the overall effectiveness of the Debt Payoff Challenge. Recent data indicate that 75% of participants reported a substantial reduction in their debt load, with an average total debt decrease of $8,000. Furthermore, 60% of dedicated participants successfully built emergency funds, illustrating a shift towards improved financial security. The challenge has also encouraged individuals to take actionable steps towards managing their debts more efficiently. Notably, more than 50% of enrollees indicated that they now actively monitor their spending habits and practice disciplined budgeting.

The testimonies and metrics provided demonstrate that the Debt Payoff Challenge offers tangible results, motivating individuals to engage with their financial circumstances proactively. These real-life successes serve as a reminder that anyone can achieve debt freedom and financial stability by committing to a structured plan and taking control of their financial future.

Additional Resources for Lasting Financial Change

Embarking on the Debt Payoff Challenge requires a commitment to change and a well-structured plan. To support participants in their journey towards financial freedom, a variety of resources are available that cater to essential aspects of debt elimination. These tools can enhance the overall experience and facilitate meaningful progress throughout the 30-day challenge.

First and foremost, daily checklists can significantly aid participants in maintaining focus and motivation. These checklists serve as reminders of tasks to accomplish each day, ensuring users adhere to the plan while cultivating productive habits. Complementing these checklists, progress tracking apps enable individuals to visualize their financial journey by recording milestones achieved and remaining debt. Having tangible evidence of progress fosters a sense of accomplishment and encourages continued dedication to financial goals.

Moreover, engaging with a community of like-minded individuals is invaluable during the challenge. Connecting with others fosters accountability and motivation, as participants can share experiences, challenges, and successes. Online forums or local support groups are excellent platforms for fostering such connections, creating a network of encouragement and assistance.

For those seeking additional strategies, workbooks filled with financial tactics and negotiation techniques can provide actionable insights. These resources guide users on effectively negotiating interest rates or consolidating debts, which can lead to significant savings. Furthermore, practical tools like debt tracker templates allow users to meticulously monitor their debts, actively engaging in the process of financial management.

In essence, by leveraging these resources, participants of the Debt Payoff Challenge can create a strong foundation for lasting financial change. Integrating these tools and community support not only equips individuals with essential strategies but also reinforces their commitment to achieving financial freedom.

Leave a Reply