Introduction to Mindful Spending

In today’s consumer-driven society, the concept of mindful spending has garnered significant attention as individuals become increasingly aware of their financial habits. Mindful spending refers to the practice of being intentional and conscious about purchasing decisions. By engaging in mindful spending, individuals can better align their expenditures with their values and long-term financial goals, fostering a sense of control over their financial well-being.

One of the most pressing challenges associated with spending is the prevalence of impulse buying. Many consumers are prone to making unplanned purchases, often driven by emotions rather than rational thought. This behavior can lead to a cycle of regret and financial instability, as individuals accumulate items that do not provide meaningful utility or satisfaction. It is essential to recognize these impulses and the underlying psychological triggers that contribute to them, which can include stress, advertising influences, and societal pressures.

Mindful spending cultivates an awareness of such triggers, allowing consumers to pause and reflect before making a purchase. This approach encourages individuals to ask important questions: Does this purchase serve a purpose in my life? Is it aligned with my financial objectives? By incorporating these reflective practices, consumers can develop healthier spending habits and ultimately make more fulfilling purchases.

The 72-hour rule serves as an effective strategy to enhance mindful spending. By waiting 72 hours before committing to a purchase, individuals create a buffer that allows for reconsideration and assessment of whether the item truly enhances their life. This practice fosters patience and thoughtful decision-making, ultimately reducing the likelihood of impulse purchases. Overall, embracing mindful spending and utilizing methods like the 72-hour rule can significantly improve financial decision-making and lead to a more satisfying relationship with money.

Understanding the 72-Hour Rule

The 72-hour rule is a powerful psychological strategy designed to aid individuals in moderating their spending habits by fostering a deliberate pause before making non-essential purchases. This approach encourages consumers to implement a waiting period of 72 hours, allowing time for reflection on their purchasing decisions. The primary objective is to separate impulsive desires from intentional choices, ultimately transforming one’s spending behaviors.

At its core, the 72-hour rule functions by establishing a wishlist for items that are considered unnecessary or extravagant. When a consumer feels the urge to buy a non-essential product, instead of proceeding to purchase it immediately, they are encouraged to write it down and wait for a period of three days. This buffering time serves as a psychological barrier, prompting individuals to evaluate their desires critically. The wait allows potential buyers to ask themselves whether the item holds genuine value or significance in their lives. Often, they may find that their desire diminishes or fades entirely, thus saving them from unnecessary expenditures.

Moreover, the 72-hour rule taps into the concept of emotional spending, which frequently leads to buyer’s remorse. By introducing a delay into the decision-making process, individuals can mitigate the influence of fleeting emotions and assess their motivations for wanting an item. This practice can improve financial discipline and encourage more mindful consumption patterns. Additionally, it empowers individuals to distinguish between genuine needs and temporary wants, facilitating better spending habits in the long run. Ultimately, the careful application of the 72-hour rule can serve as an effective tool for anyone looking to transform their financial landscape through improved decision-making skills.

Why the 72-Hour Rule Works

The 72-hour rule serves as a powerful psychological tool designed to reshape one’s spending habits. At its core, this approach emphasizes a waiting period before making non-essential purchases, which effectively disrupts the impulsive nature of consumer behavior often driven by dopamine release. Dopamine is a neurotransmitter linked to pleasure and reward, and its surge can lead individuals to make quick decisions, resulting in regrettable spending choices. By introducing a mindful pause, the 72-hour rule allows the emotional high associated with immediate gratification to wane, promoting a clearer perspective on financial commitments.

Moreover, this rule fosters rational thinking and encourages individuals to assess their purchases critically. The waiting period enables consumers to evaluate the necessity of the item in question, thus aiding in distinguishing between wants and needs. During this time, individuals can reflect on whether a purchase aligns with their financial goals and values, leading to more thoughtful decision-making processes. Such reflection diminishes the likelihood of buyer’s remorse, as individuals are less inclined to purchase an item out of impulse.

In addition, the rule creates a natural barrier to unnecessary spending. With the initial urge to purchase curtailed, individuals often find themselves reconsidering the impulsivity of their desires. Over time, this practice can build a healthier relationship with money, allowing them to prioritize their financial well-being over momentary wants. By understanding that some desires may evaporate after a few days, individuals can cultivate a more disciplined approach to spending that enhances overall financial stability. In summary, the 72-hour rule harnesses the power of reflection and rationality, significantly transforming how one navigates their consumption patterns. This psychological hack can ultimately lead to more mindful spending habits that emphasize value over impulse.

Real-Life Applications of the 72-Hour Rule

Implementing the 72-hour rule in your daily life can serve as a transformative strategy for improving spending habits. This rule encourages individuals to allow a significant gap between impulse decision-making and actual purchasing—an interval that can help facilitate more rational financial choices. One practical tip for effectively applying this principle is to create a digital wishlist. When you encounter a tempting product, instead of making an immediate purchase, add it to your wishlist. This allows you to take the necessary time to reflect on whether this item aligns with your needs and priorities without the pressure of impulse buying.

Each time you feel the urge to purchase, you can start the three-day countdown. By setting a specific time frame, you create a buffer that not only helps to quell the initial excitement surrounding the purchase but also encourages deeper contemplation about the item’s necessity. Often, you may find that after a 72-hour period, the excitement fades, and the item is ultimately forgotten. This insight can be surprising for many, revealing the extent to which impulsive desires influence spending habits.

Additionally, consider creating a monthly review of your wishlist items. At this point, assess what you still desire after the three-day reflection period. This practice can highlight forgotten items or those that have lost their appeal over time, offering significant savings. As you integrate the 72-hour rule into your spending habits, it not only fosters more thoughtful purchasing decisions but also empowers you to distinguish between genuine wants and fleeting whims, thus promoting healthier financial behaviors over time.

Success Stories: Transformative Results from the 72-Hour Rule

The 72-hour rule has gained considerable attention as an effective psychological tool for influencing spending habits. Many individuals who have adopted this strategy have reported significant changes in how they make purchasing decisions and manage their finances. For instance, Sarah, a 30-year-old marketing professional, shared her experience of battling impulsive buying. After implementing the 72-hour rule, she took a moment to reflect before making any substantial purchases. Instead of instantly clicking “buy,” she began allowing a period of 72 hours to elapse. Over time, she realized that many desired items lost their appeal, leading to a marked decrease in unnecessary expenditures. This approach not only helped her save money but also fostered a sense of control over her finances.

Another compelling case comes from Tom, a teacher who faced challenges with credit card debt. After learning about the 72-hour rule from a personal finance seminar, Tom decided to apply it rigorously. He documented his spending habits before and after embracing the rule. Initially, he found himself purchasing non-essential items frequently, but after a month of practicing the waiting period, he observed a substantial drop in his usage of credit. Tom reported that his debt started to decrease gradually, and he developed a more conscious approach towards budgeting. Ultimately, Tom appreciated the increased clarity the rule provided, enabling him to prioritize needs over wants.

These testimonials underscore the transformative potential of the 72-hour rule in shaping one’s approach to spending. Participants often describe a newfound awareness regarding financial choices and a heightened sense of accountability for their expenditures. By reflecting on purchases before committing, individuals not only improve their savings but also nurture healthier financial habits. As seen, these success stories serve as inspiration for others seeking to regain control over their spending behavior.

Common Challenges and Solutions

Applying the 72-hour rule can present various challenges, particularly in a consumer-driven environment. One of the most prevalent issues individuals face is overcoming strong impulses. In moments of desire, the urge to buy can feel overwhelming, prompting immediate purchases without considering the long-term impact. Additionally, social pressures can exacerbate this challenge, with friends or family members influencing spending behaviors—subtly or overtly encouraging impulsive purchasing decisions. Recognizing these factors is crucial for successfully adhering to the waiting period.

To tackle these challenges, it’s essential to establish clear parameters for applying the 72-hour rule. Start by setting firm criteria for what qualifies as an impulsive purchase. This could include items beyond a certain monetary value or products that you have not previously planned or needed. When faced with a tempting purchase, take a moment to assess whether it meets those established criteria. If it does, implement the waiting period. During this time, engage in reflection; consider the necessity of the item, its alignment with your financial goals, and alternative uses for your resources.

Another practical solution is to create a support system. Share your commitment to the 72-hour rule with trusted friends or family who can provide encouragement and remind you to hold off on unnecessary spending. Additionally, you can utilize technology to assist in your efforts. Some budgeting apps have features to set reminders or alerts when you are at the risk of impulse buying. Finally, redirecting your focus during the waiting period can be beneficial. Engaging in hobbies, exercising, or investing time in personal growth can help mitigate the immediate urge to spend while reinforcing your commitment to transform your spending habits.

Enhancing the 72-Hour Rule with Other Mindful Spending Techniques

The 72-hour rule serves as a powerful strategy to curb impulsive purchases by encouraging a reflective pause. To bolster this technique, integrating additional mindful spending practices can further enhance one’s financial discipline. One effective method is budgeting, which involves creating a financial plan that allocates funds to different categories, ensuring that spending aligns with personal financial goals. By establishing a clear budget, individuals gain a comprehensive understanding of their financial situation and can make more informed purchasing decisions. Additionally, budgeting acts as a tangible reminder of priorities, potentially lessening the allure of non-essential items.

Another complementary technique is expense tracking. This practice involves carefully monitoring all expenditures, enabling individuals to see where their money goes each month. An awareness of spending patterns not only highlights unintentional overspending but also fosters accountability. Many find that keeping a written log or using digital tools to track expenses cultivates a greater appreciation for their financial choices, further reinforcing the benefits of the 72-hour wait period.

Moreover, mindfulness practices can play a significant role in developing a more thoughtful approach to spending. Techniques such as meditation or journaling can help individuals process their emotions and thoughts surrounding financial decisions. By fostering a greater sense of awareness, these practices encourage a deeper consideration of the motives behind a purchase, potentially highlighting areas where emotional triggers lead to impulsive buying. Engaging in mindfulness exercises can complement the waiting period advocated by the 72-hour rule, allowing time for clarity and promoting more intentional financial behavior.

Incorporating budgeting, expense tracking, and mindfulness into daily routines can significantly enhance the effectiveness of the 72-hour rule and encourage healthier spending habits. These combined techniques not only empower individuals to become more conscious of their financial choices but also cultivate lasting changes in their relationship with money.

Creating Your Personalized 72-Hour Rule Tracker

Implementing the 72-hour rule effectively necessitates a structured approach to tracking spending impulses and habits. A personalized tracker can significantly enhance this process, enabling you to remain mindful of your financial decisions. There are various methods you can employ to create a system that suits your lifestyle and preferences.

One of the simplest options is to use printable templates. These templates can be designed to include sections for the date of impulse spending, the item considered for purchase, and a space to jot down your feelings or reasons for wanting to make the acquisition. By filling out this template, you create a tangible record that encourages reflection before making a purchase. You can find numerous free templates online that are easily customizable to fit your needs.

For those who prefer a digital approach, mobile applications and digital tools offer a convenient alternative. Many budgeting apps have built-in features that can help you establish your 72-hour tracking system. By setting alerts or reminders within these apps, you can ensure that you take the necessary 72 hours to reflect on any potential purchases. Popular applications, such as Mint or YNAB (You Need A Budget), allow you to categorize your expenses and provide insights into your spending patterns, which can further enhance your understanding of your financial behavior.

Moreover, if you are tech-savvy, you may consider creating an Excel spreadsheet or using Google Sheets for real-time tracking. This approach allows for added customization, enabling you to analyze your spending habits visually through graphs and charts. Including elements like budget goals or spending categories can aid in keeping your finances in check while promoting accountability.

Ultimately, whether you opt for printable templates, mobile apps, or digital tools, the key is to create a system that resonates with your unique style and helps you adhere to the 72-hour rule successfully.

Conclusion: Your Path to Mindful Spending

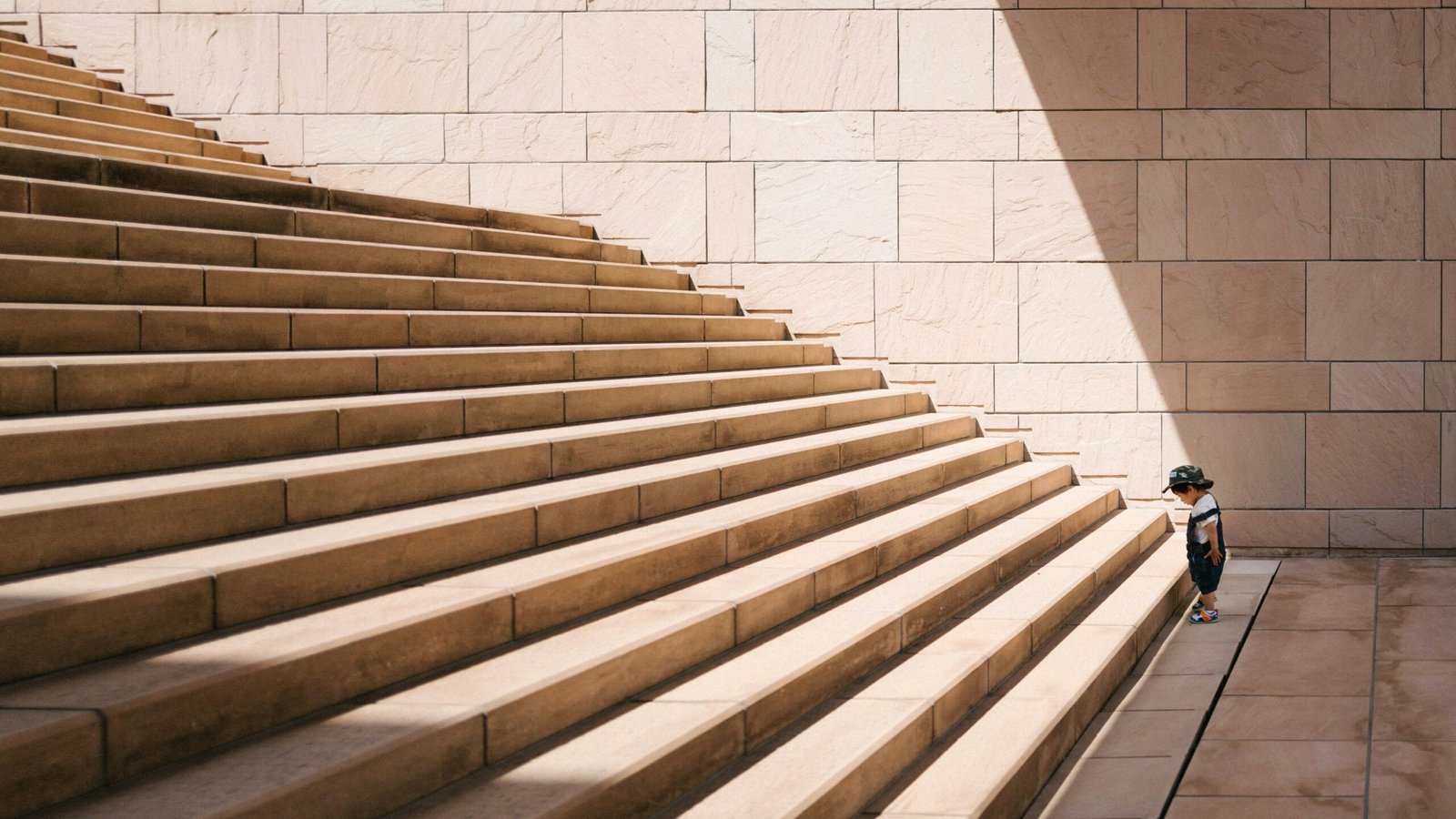

As we navigate an increasingly consumer-driven society, the importance of maintaining control over our spending habits cannot be overstated. The 72-hour rule presents an effective psychological strategy that can help individuals develop more mindful spending patterns. By encouraging a pause before making purchases, the rule allows you to evaluate whether an item is truly necessary or simply a fleeting desire. This mindful approach to spending can substantially reduce impulse purchases, leading to healthier financial decisions.

Adopting the 72-hour rule as a lifelong practice can yield several benefits for your financial health. It fosters a mindset focused on conscious consumption, grounding your spending habits in intentionality. This transformation is not only beneficial for your wallet but also contributes to a sense of personal discipline, allowing you to prioritize your needs over wants. Additionally, the emotional satisfaction derived from considered purchases often outweighs the fleeting gratification gained from impulsive buys.

Taking action towards implementing this rule is the first step toward mastering your finances. Start by noting down items you desire and revisiting them after the 72-hour period. This simple yet effective technique can greatly enhance your decision-making process and encourage you to become more selective with your purchases. Furthermore, for those seeking additional support, resources like spending trackers can provide vital insights into your buying habits.

By committing to the 72-hour rule and considering tools available to aid in tracking your spending, you can embark on a journey towards enduring financial health. Take the first step today; with diligence, the benefits of conscious spending will unfold, paving the way for a more secure financial future.

Leave a Reply