Introduction to Wealth Building

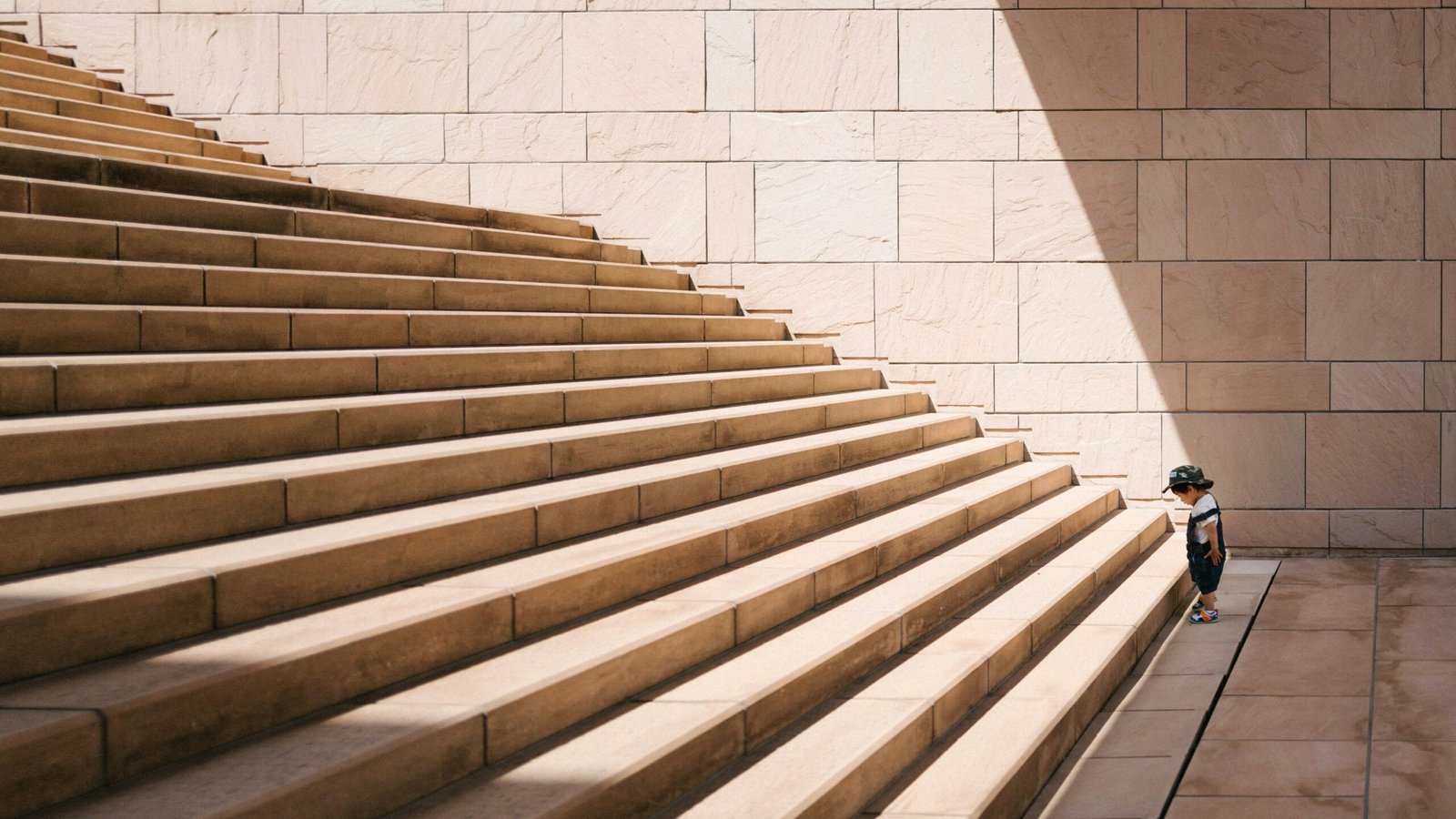

Wealth building is a crucial aspect of financial education and personal finance management. It is a multi-faceted concept that involves strategic planning, informed decision-making, and disciplined investment. The journey toward financial security begins with understanding wealth building principles, which can empower individuals to transition from being complete beginners to knowledgeable investors. By investing time and resources wisely, anyone can cultivate a prosperous financial future.

The importance of wealth building cannot be overstated. In today’s fast-paced economy, individuals need to establish a sound financial foundation to navigate uncertainties and pursue their aspirations. Accumulating wealth enables individuals to fund essential life milestones, such as homeownership, education, and retirement, while also providing a sense of security and peace of mind. For those starting with minimal resources, the wealth building process may appear daunting; however, it is important to recognize that small, consistent actions can yield substantial results over time.

This blog post aims to provide straightforward, actionable tips designed to facilitate a successful financial journey for beginners. Whether you are just starting to manage your finances or seeking to enhance your understanding of investment opportunities, these tips are tailored to fit various financial situations, budgets, and goals. The objective is to demystify wealth building, making it accessible to everyone, regardless of their current financial standing. With the right guidance and determination, anyone can embark on the path to financial growth and stability.

The Foundation Phase: Month 1-3

Building a solid financial foundation is crucial for anyone embarking on the journey of wealth accumulation. During the initial months, particularly the first three, individuals must focus on cultivating a positive money mindset. This involves examining personal beliefs and attitudes towards money. By identifying negative mindsets, individuals can work to replace them with empowering thoughts that encourage responsible financial behavior. Adopting a proactive mental approach sets the stage for future financial growth.

Another significant aspect of the foundation phase is the establishment of clear financial goals. Setting goals provides direction and motivation, allowing individuals to visualize what they aim to achieve financially. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Regular review of these financial goals is equally important; it allows for necessary adjustments based on changing circumstances or insights gained during the wealth-building process.

Furthermore, maintaining a money journal can be immensely beneficial during this phase. A money journal serves as a personal documentation tool, capturing income, expenses, and financial habits. By consistently tracking financial behavior, individuals can identify patterns and areas for improvement. This practice not only engenders accountability but also helps pinpoint spending triggers and encourages thoughtful decision-making.

Engaging in financial education is equally essential to fortify the foundation of wealth building. Individuals should seek out books, online courses, and workshops that cover basic and advanced financial topics. This commitment to learning enhances financial literacy, enabling better decision-making and strategy development. Equipped with knowledge and insights, individuals can confidently navigate their financial future and craft a tailored wealth-building strategy that resonates with their personal financial landscape.

Money Mindset Development

The foundation of successful wealth-building begins with cultivating a positive money mindset. Understanding that your beliefs about money can significantly influence your financial decisions is crucial. A constructive mindset not only encourages wise financial choices but also instills a sense of empowerment regarding one’s financial future.

One of the practical steps in developing this mindset involves daily financial affirmations. These are positive statements that you can use to challenge and overcome negative beliefs related to money. For example, repeating phrases such as “I am capable of managing my finances effectively” or “I attract wealth and abundance” can transform your subconscious beliefs. It is beneficial to recite these affirmations in front of a mirror each morning, setting a positive tone for the day ahead.

An essential component of a positive money mindset is success visualization. This technique involves mentally picturing your financial goals as if they have already been achieved. By visualizing what financial success looks like—whether it’s owning a home, saving for retirement, or becoming debt-free—you create a mental image that motivates and guides your actions. This practice can increase your subconscious commitment to your goals, reinforcing the belief that they are within reach.

Another practical tool for developing a positive money mindset is maintaining a money journal. This journal serves as a safe space to record your financial thoughts, feelings, successes, and challenges. By reflecting on your money experiences, you can identify patterns in your financial behavior and adjust your mindset accordingly. Documenting triumphs, no matter how small, nurtures gratitude and encourages a forward-focused attitude that is essential for wealth building.

Ultimately, adopting a positive money mindset can significantly impact your financial journey. By integrating daily affirmations, visualizations, and reflective journaling into your routine, you cultivate an empowering perspective that facilitates sound financial decisions and progresses toward your wealth-building goals.

Smart Money Basics

Establishing a solid financial foundation is crucial for anyone looking to transform their financial future. For beginners, understanding the fundamentals of money management can significantly impact their ability to build wealth. One essential technique is zero-based budgeting. This method involves allocating every dollar of your income to specific expenses, savings, or debt repayment. By doing so, you ensure that every dollar served a purpose, minimizing unnecessary expenses and maximizing your savings potential. This approach encourages mindful spending and helps individuals track their financial goals more effectively.

Another valuable strategy for beginners is implementing a 24-hour purchase rule. This rule requires a mandatory waiting period of 24 hours before making any non-essential purchases. By allowing time to reflect on the necessity of the expense, individuals can reduce impulse buying and make more conscious decisions about their spending patterns. This small change can lead to significant savings over time and empower individuals to prioritize their financial well-being.

Creating a receipt tracking system is another practical technique for those new to managing their finances. Keeping track of receipts helps monitor spending habits and identify areas where cuts can be made. Utilizing apps or simply organizing receipts in a dedicated folder can streamline this process and provide valuable insights into overall spending trends.

Additionally, optimizing bills is an effective way to enhance financial management. Beginners should review their subscriptions, utility bills, and other recurring expenses to ensure they are paying the best rates possible. This may involve shopping around for better deals, negotiating prices, or even downgrading plans to minimize costs. By being proactive in managing bills, individuals can free up more resources for savings or investments.

Implementing these foundational money management techniques can empower beginners to take control of their financial futures, fostering habits that support long-term wealth building.

Debt Management Strategies

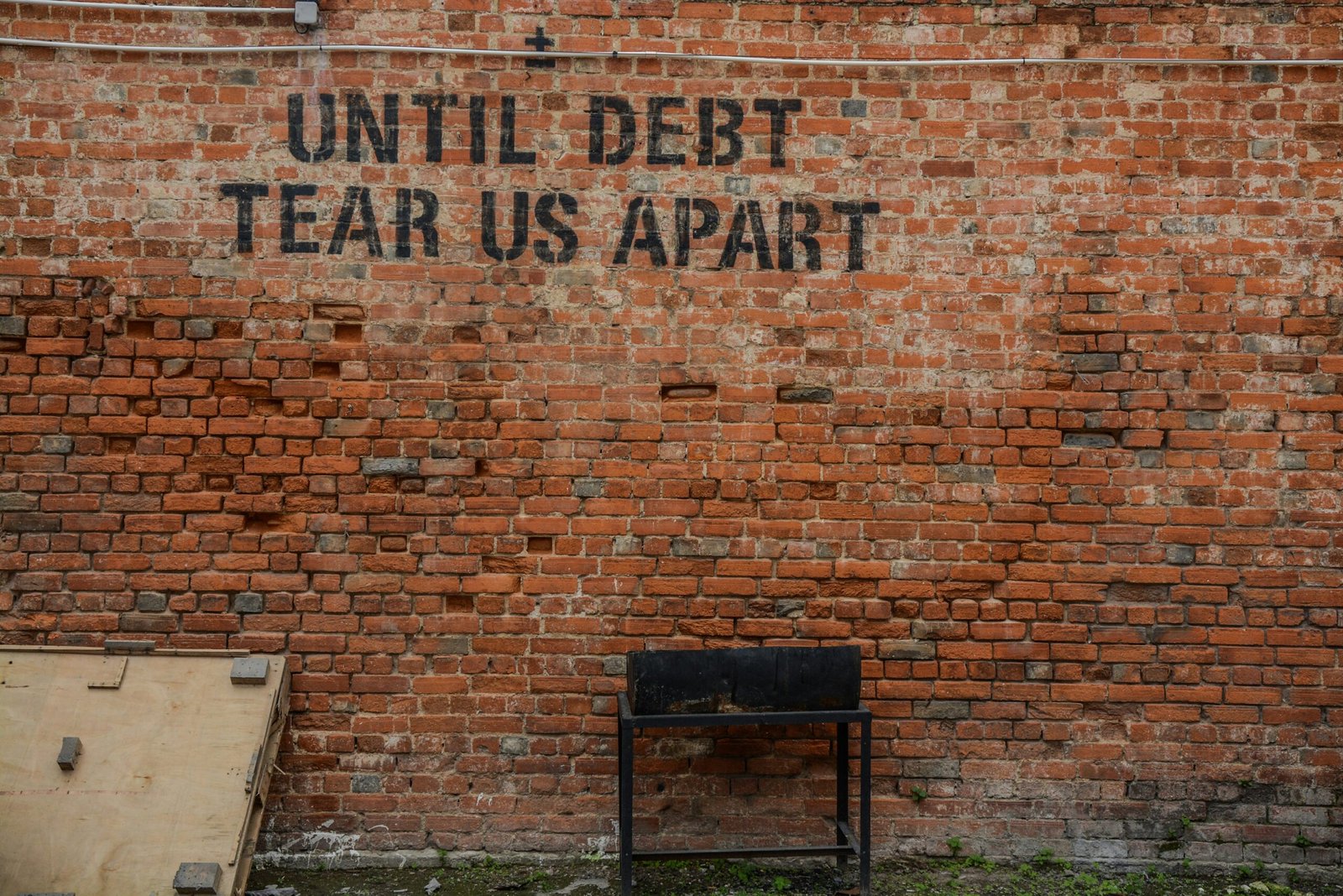

For individuals beginning their journey toward financial stability, effective debt management is paramount. The first step in this process is to conduct a thorough debt inventory, which involves listing all outstanding debts along with their respective balances, interest rates, and due dates. This comprehensive overview enables one to understand the total debt burden, assisting in prioritization and strategy formulation. By categorizing debts into secured and unsecured, as well as distinguishing between high and low-interest debts, individuals can make informed decisions regarding which debts to tackle first.

Once the debt inventory is complete, the next crucial step is to explore the possibility of negotiating interest rates with lenders. Many borrowers overlook this option, yet it can lead to significant savings over time. By demonstrating a responsible payment history and expressing willingness to discuss alternatives, individuals may find that lenders are amenable to reducing rates, thereby lowering monthly payments and overall interest costs.

Choosing the right payoff strategy is also critical to effective debt management. Two popular methods are the snowball and avalanche methods. The snowball method focuses on paying off the smallest debts first to build momentum and motivation, while the avalanche method prioritizes high-interest debts, ultimately saving money on interest payments. Each method has its advantages, and selecting the one that aligns with personal financial behavior can lead to greater success.

Consistently tracking progress is equally important. By keeping a close eye on debt repayment status and changes in credit scores, individuals can celebrate milestones and remain motivated throughout the process. Utilizing financial tools such as spreadsheets or budgeting apps can aid in visualizing progress and ensuring that debt management remains a priority. Overall, strategic debt management not only facilitates the reduction of liabilities but also fosters improved financial health for the future.

The Growth Phase: Month 4-6

As individuals transition into the growth phase of wealth building between months four to six, it becomes crucial to pivot from foundational practices to more advanced strategies. This period serves as an opportunity to assess one’s financial landscape, focusing particularly on investment fundamentals that will underpin future growth. One of the preliminary steps involves gauging one’s risk tolerance. Understanding how much risk one is comfortable with is essential, as this determination will significantly influence the types of investments chosen. Beginners should reflect on their financial goals, their timeline, and their emotional response to market fluctuations, which can often guide them towards safer or more aggressive investment choices.

Next, it is vital to grasp the concept of asset allocation. This financial strategy is about distributing investments among various asset categories, such as stocks, bonds, and real estate. Proper asset allocation helps mitigate risk while optimizing the potential for returns. A diversified portfolio, catered to match one’s risk tolerance, can balance the ups and downs of the market, reducing the likelihood of significant losses during economic downturns.

Furthermore, the importance of portfolio diversification cannot be overstated. By incorporating a range of asset types, investors can protect their wealth against localized market declines, allowing gains in one area to offset losses in another. Diversification extends not only across asset classes but can also encompass geographical regions and sectors. As newcomers begin investing, they must remember that diversification is not just a strategy; it is a necessity in managing risk effectively. In this growth phase, beginning investors should take calculated steps toward building a more robust financial portfolio, ensuring it aligns with their long-term objectives and risk profile.

Investment Fundamentals for Beginners

Understanding investment fundamentals is crucial for anyone looking to enhance their financial future. Investing is not merely a means to grow wealth but is also a strategic approach that requires informed decision-making. One essential aspect of investing is recognizing market cycles. The market is characterized by various phases, including expansion, peak, contraction, and trough. Being aware of these cycles can help beginners time their investments effectively and optimize returns.

Choosing the right investment vehicles is another critical consideration for novice investors. Investment vehicles can range from stocks and bonds to real estate and mutual funds. Each of these options carries its own risk and return profile, making it imperative for investors to assess their risk tolerance before committing funds. For instance, stocks generally offer higher potential returns but come with increased volatility, while bonds typically provide more stable but lower returns. Understanding these differences helps beginners select the appropriate assets aligned with their financial goals.

Additionally, rebalancing a portfolio is a fundamental practice that should not be overlooked. Over time, the value of investments may shift, resulting in an allocation that no longer matches an investor’s risk appetite or financial objectives. Regularly rebalancing a portfolio not only realigns investments with target allocations but also enhances long-term performance by preventing overexposure to specific assets. This practice is particularly vital during periods of market volatility, where diversifying investments can mitigate risk.

By grasping these investment fundamentals—market cycles, appropriate investment vehicles, and portfolio rebalancing—beginners can build a solid foundation for their wealth-building journey. Equipped with this knowledge, they can navigate the complexities of investing with increased confidence, setting the stage for long-term financial success.

Income Expansion Tactics

Expanding your income is a crucial step in establishing a secure financial future. One of the first strategies to consider is conducting a thorough skill audit. Take stock of your current abilities and experiences; this process helps identify marketable skills that can be leveraged in the job market. Understanding what sets you apart allows you to pursue roles that not only compensate you fairly but also align with your passions and strengths.

Another effective strategy for income expansion is exploring side hustle opportunities. With the rise of the gig economy, numerous platforms allow individuals to offer their services on a freelance basis. Whether it’s graphic design, consulting, tutoring, or any other skill you possess, having a side hustle can significantly supplement your income. This additional revenue stream does not just provide financial security; it also offers a chance to test new business ideas without a substantial initial investment.

Planning for passive income is essential for long-term financial growth. Passive income sources, such as investments in stocks, real estate, or creating digital products, free up your time while steadily increasing your financial assets. By ensuring that you have multiple income streams, you mitigate the risks associated with relying solely on a single paycheck.

Career advancement mapping is another vital component of income growth. This involves setting clear professional goals and identifying potential paths for upward mobility in your current job. Engaging in mentorship opportunities and continuous education can facilitate this process, leading you to positions with higher earning potential.

Lastly, building a robust professional network is invaluable. Networking can reveal job opportunities, partnerships, and strategies for income expansion. By diversifying income streams through various avenues, you lay a solid foundation for financial stability and success.

Detailed Implementation Plan

Transforming your financial future necessitates a clear plan of action. In the first two months, beginners should focus on several key tasks to build a strong foundation for wealth accumulation. This detailed implementation plan outlines practical steps to help you stay on course.

Initially, conducting a financial audit is crucial. Begin by gathering all financial statements, including bank accounts, credit card bills, loan documentation, and investment portfolios. List your income sources and determine your total monthly earnings. Following this, compile a comprehensive inventory of your expenses. Categorizing these expenses will enable you to pinpoint areas where you can cut costs or save more efficiently.

Once your financial audit is complete, it is imperative to set up tracking accounts. Utilize budgeting software or spreadsheets to monitor your income and expenses. This tracking system will provide real-time insights into your financial habits and allow you to adjust your spending as necessary. Make it a habit to input transactions regularly, which will reinforce your commitment to tracking your financial progress.

Next, develop a budget system that aligns with your financial goals. Start by determining fixed and variable expenses. Allocate funds to essential categories such as housing, utilities, groceries, and transportation, while ensuring you prioritize savings and debt payments. Allocating a percentage of your income to savings can ensure that you are steadily building your wealth base over time.

Finally, schedule bi-weekly reviews of your financial status. Assess your budget adherence, expenditures, savings progress, and any outstanding debts. This regular check-in will help you stay accountable and facilitate necessary adjustments. By following this structured implementation plan, you can systematically transform your financial future and take the crucial steps needed to achieve financial independence.

Conclusion: Your Path to Financial Success

As we have explored throughout this blog post, building wealth is not an overnight endeavor; it requires careful planning, informed decision-making, and consistent action. The essential wealth building tips discussed serve as a roadmap for beginners who are eager to enhance their financial future. Understanding the foundational principles of budgeting, saving, investing, and diversifying one’s financial portfolio is critical to achieving long-term financial stability.

One of the key takeaways is the importance of setting clear financial goals. Whether you aim to save for retirement, purchase a home, or fund your children’s education, having specific objectives in place will guide your financial decisions and help maintain your motivation. Additionally, making informed choices around investments—such as choosing low-cost index funds or contributing to a retirement account—can significantly impact your wealth accumulation over time.

Moreover, it is essential to cultivate a habit of saving. Establishing an emergency fund and automating savings can provide a safety net and foster financial discipline. Implementing these habits ensures that you are prepared for unexpected expenses while staying committed to your long-term financial aspirations.

Remember, building wealth is a journey—it involves ongoing education and adaptation. Take the time to learn about various investment vehicles, explore options to increase your income, and consider consulting with a financial advisor to refine your strategies. By adopting the wealth-building strategies outlined in this post, you are setting yourself on a promising path toward financial success. Start today, make informed decisions regularly, and embrace the journey to transform your financial future.

Leave a Reply