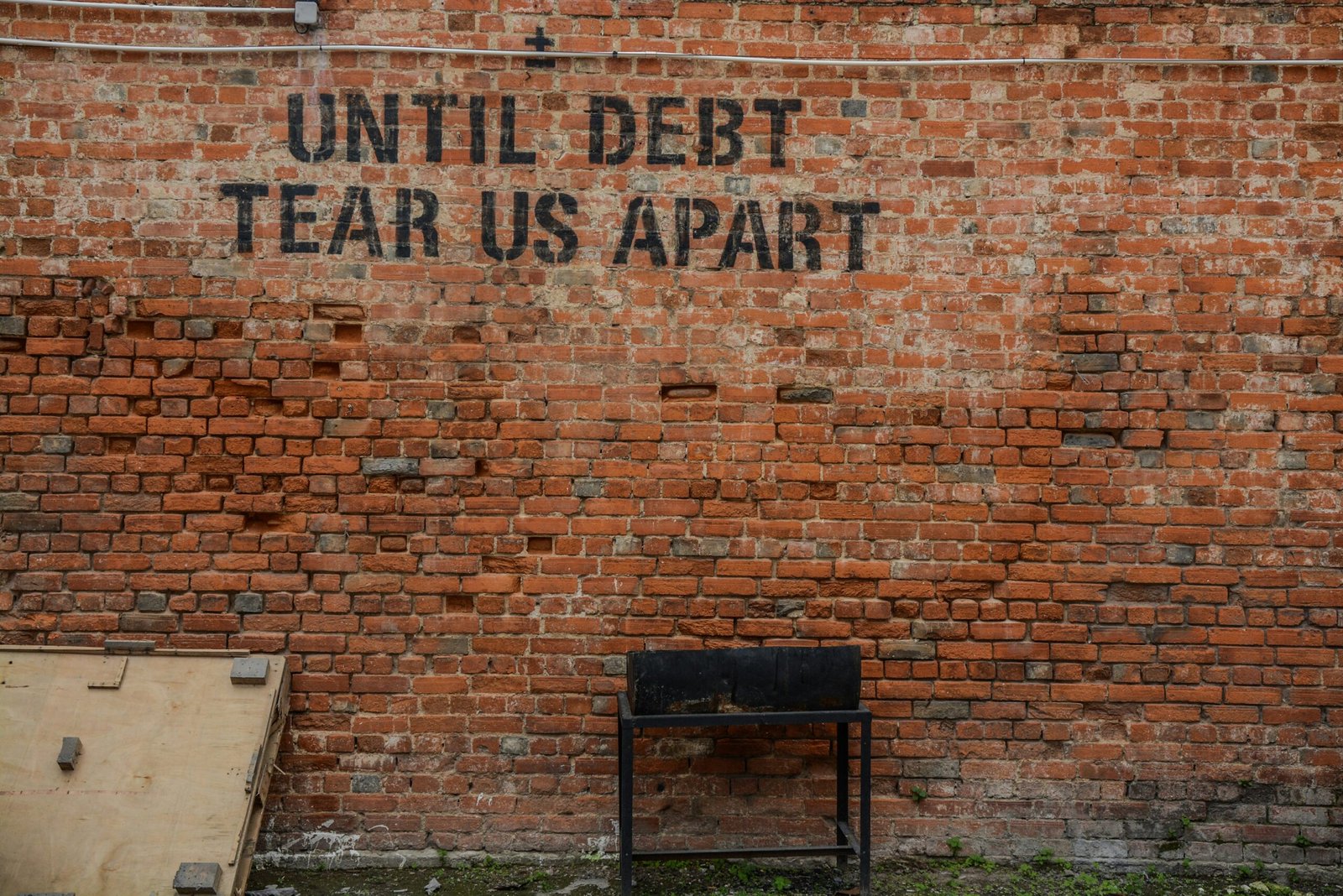

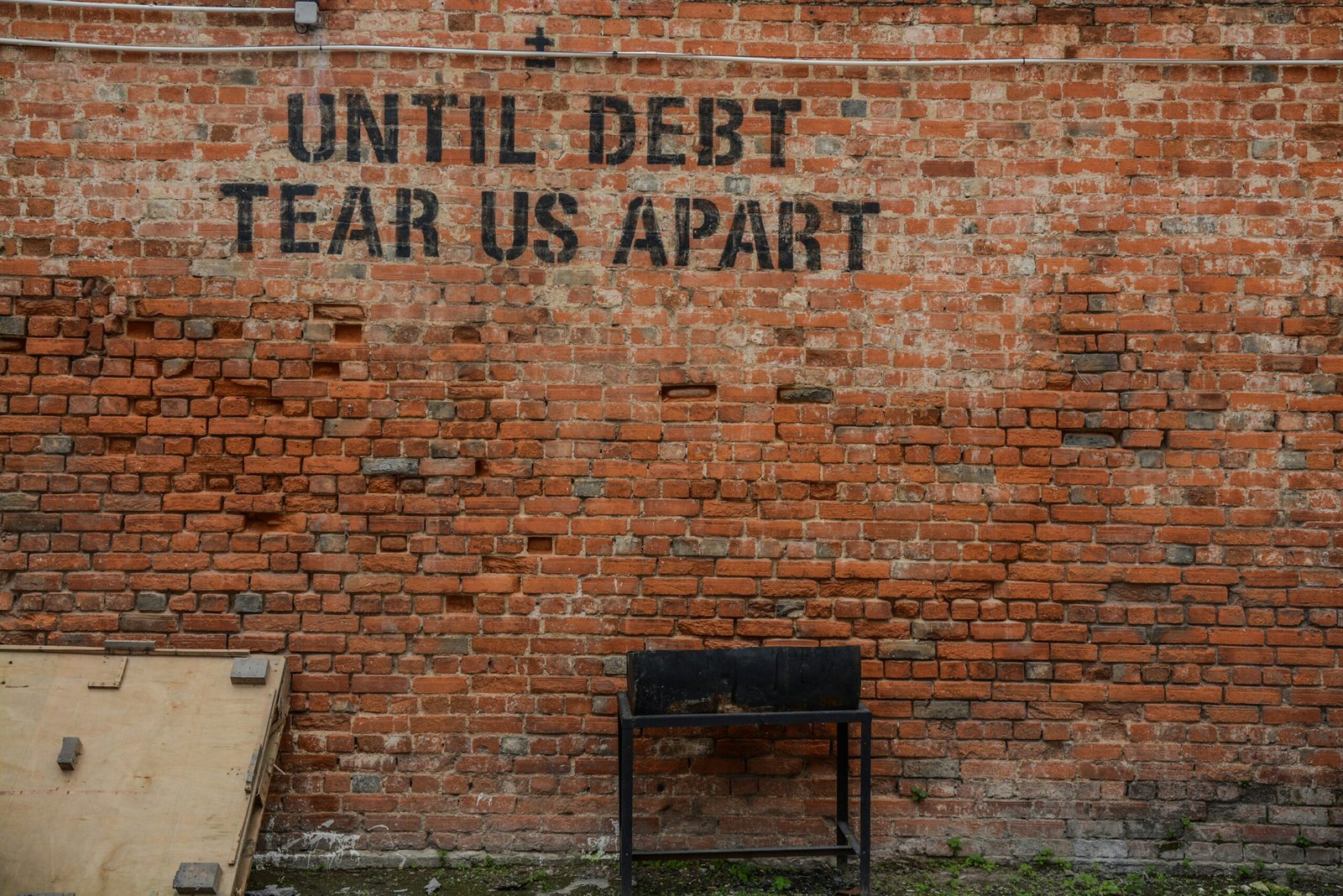

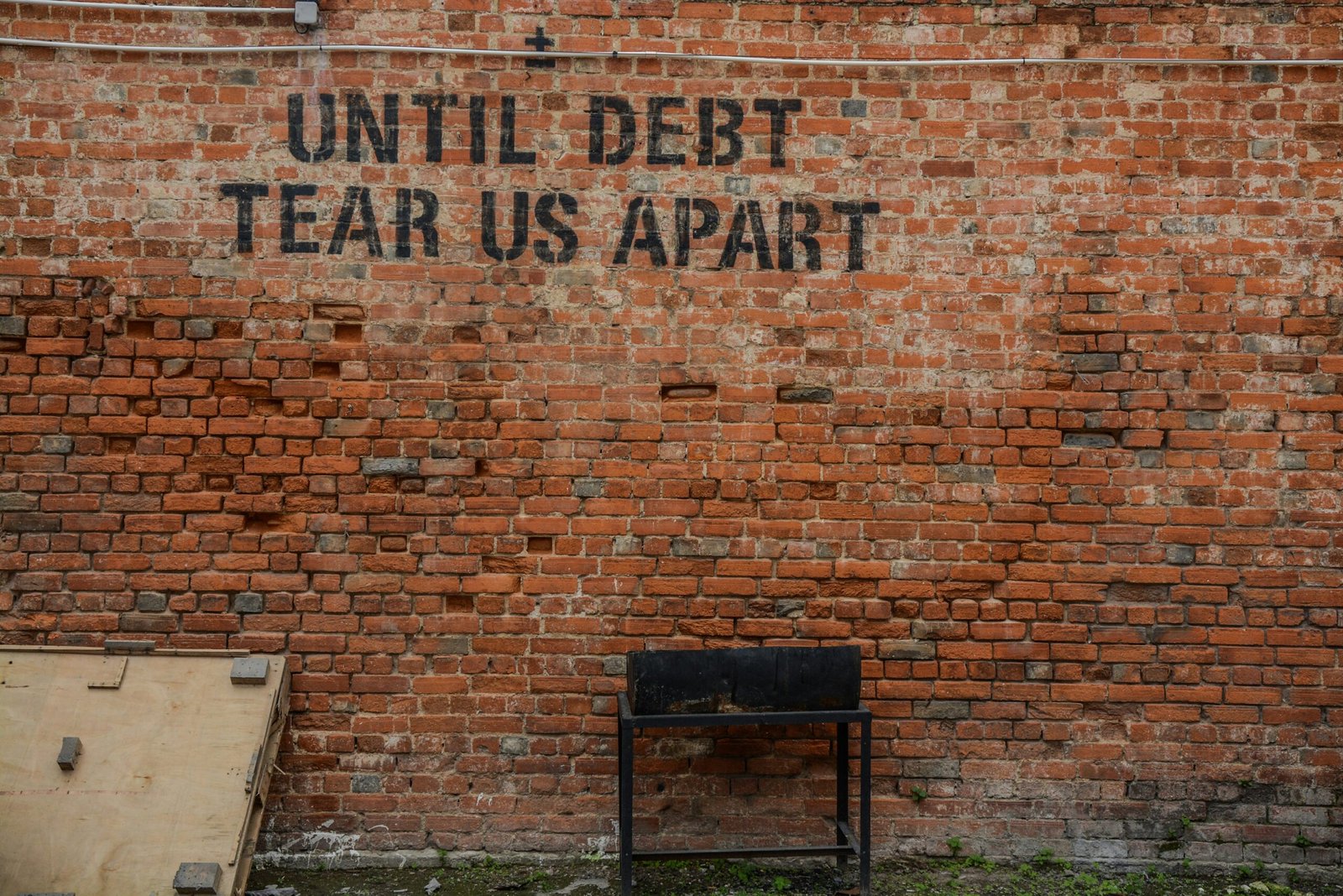

Introduction: The Hidden World of Debt Management

Debt elimination is a crucial step toward achieving financial freedom, a state of being that many aspire to yet find elusive due to various financial obligations. In today’s society, where credit cards, loans, and other forms of debt are commonplace, the knowledge of effective debt management techniques can play a striking role in one’s financial landscape. Unfortunately, many consumers remain unaware of the most effective strategies for reducing their debt burden, often due to a lack of transparency from financial institutions.

Financial institutions, while offering a range of products designed to assist consumers, frequently keep certain debt payoff strategies under wraps. This can lead borrowers to miss out on valuable opportunities for debt reduction and efficient repayment. For instance, many may not realize the benefits of debt consolidation, which can simplify payments and potentially lower interest rates, or the impact of negotiating with creditors to achieve more favorable terms.

Moreover, the media is often flooded with one-size-fits-all solutions that may not address individual circumstances, leaving many to feel disheartened in their quest for financial stability. It is imperative for consumers to delve deeper into the hidden aspects of debt management that could lead to significant advancements in their efforts to become debt-free. The aim is not merely to eliminate debt but to empower individuals with knowledge that fosters confident financial decision-making.

This insightful guide will unravel essential insider tips and strategies that can transform an overwhelming debt repayment journey into a manageable process. With a focus on actionable steps and practical advice, the goal is to illuminate pathways to financial liberation in 2024. By understanding and utilizing the right techniques, the dream of a debt-free life can become a attainable reality.

Understanding Your Debt: A Comprehensive Overview

Debt is a common aspect of modern financial life, and understanding the different types of debt is crucial for effective management. Consumers typically face several common forms of debt, including credit card debt, personal loans, and student loans. Each type has unique characteristics, implications, and mechanisms influencing their overall costs.

Credit card debt is one of the most prevalent forms of debt among consumers. It often features high-interest rates, sometimes exceeding 20%, which can lead to significant financial burdens if not managed properly. A staggering 23% of U.S. adults reported having credit card debt in 2023, illustrating the widespread challenge of high-interest debt accumulation.

Personal loans provide another avenue for consumers seeking financing. Unlike credit cards, these loans generally have fixed repayment terms and lower interest rates. Research indicates that the average personal loan interest rate hovers around 10% to 12%. However, borrowers must consider the terms and conditions, as late payments can severely impact credit scores and lead to a downward spiral of additional fees and higher interests.

Student loans represent a unique subset of consumer debt, often necessary for obtaining higher education. With over 44 million borrowers in the United States, student loan debt has reached an alarming $1.7 trillion. This type of debt can carry federal protections not found in other forms, such as deferment and income-driven repayment plans, yet its long-term financial implications can be daunting, especially for recent graduates entering the workforce.

Understanding interest rates is fundamental in managing these debts. Interest rates determine how much a borrower pays over the life of the loan, compounding costs if payments are missed. Maintaining a good credit score can help secure better interest rates, thereby reducing overall debt levels. By gaining insight into the intricacies of these debt types and their characteristics, consumers can better prepare themselves for the effective strategies that follow in their journey toward financial freedom.

Insider Strategy #1: Little-Known Credit Card Tricks

Credit card debt can be overwhelming, but employing certain lesser-known strategies can pave the way toward effective debt elimination. One such approach is utilizing balance transfers. Balance transfers allow you to move outstanding debt from one credit card to another, often taking advantage of lower interest rates offered by the new card. Many credit card companies provide promotional periods with 0% APR, which can lead to substantial savings on interest payments. However, it’s crucial to be aware of any transfer fees and the duration of the promotional rate to maximize potential benefits.

Understanding promotional rates is another key tactic. Credit card companies frequently offer promotional, introductory rates that can significantly reduce your monthly payments. By timing your applications, you can capitalize on these offers, reducing your overall debt more quickly. Additionally, once the promotional period expires, it is wise to switch to another card with a similar offer, ensuring that you take continuous advantage of lower rates. This strategy not only helps in managing payments but also allows more of your money to go towards paying off the principal, thereby accelerating your journey to financial freedom.

Furthermore, leveraging rewards programs diligently can facilitate debt payoff. Many credit cards provide cashback, points, or other rewards that can be utilized to offset your credit card balance. Be mindful of choosing cards that align with your spending habits, as appropriate utilization can yield significant savings. This method, however, should be approached with caution to avoid accumulating more debt in the process. Lastly, negotiating with credit card companies for lower interest rates is an underappreciated tactic. Often, lenders are willing to adjust rates to retain customers, especially if you have been a responsible cardholder. By combining these strategies, individuals may discover that knowledge truly is power in the pursuit of financial freedom.

Insider Strategy #2: Hidden Debt Consolidation Methods

Debt consolidation can often be perceived as a straightforward process, traditionally involving standard loans or credit cards. However, there exist unconventional methods worth exploring that may yield greater benefits in managing and eliminating debt. Various governmental bodies, nonprofit organizations, and alternative lenders offer unique programs designed to assist individuals in consolidating their debts with lower interest rates or improved payment terms. These lesser-known avenues can significantly enhance one’s financial management strategies.

Government agencies frequently provide assistance programs aimed at stabilizing financial hardships. For example, the Federal Housing Administration (FHA) offers programs that allow homeowners to consolidate their debts through refinancing their mortgages. Alternative debt relief options may include income-driven repayment plans for federal student loans, where monthly payment amounts can be lowered based on one’s income. Furthermore, nonprofit credit counseling services can negotiate on behalf of individuals, consolidating multiple debts into a single monthly payment, often at reduced interest rates.

Additionally, alternative lenders are emerging with innovative solutions such as peer-to-peer lending platforms. These platforms connect borrowers directly with individual investors willing to finance loans, often at lower rates compared to traditional financial institutions. This method not only creates opportunities for better interest terms but also provides a more flexible repayment structure tailored to individual circumstances.

The potential for accelerated debt payoff through these hidden consolidation methods is illustrated by numerous success stories. For example, individuals who have utilized credit counseling services report significant reductions in both interest payments and the total repayment period. By exploring these unconventional methods, individuals can place themselves in a more advantageous situation, fostering the path toward financial independence.

Insider Strategy #3: Secret Interest Rate Reduction Techniques

One of the most effective strategies for alleviating debt burdens involves negotiating lower interest rates on credit cards. For consumers grappling with high credit card payments, understanding how to effectively approach lenders can significantly impact their financial health. The key to successful negotiation lies in your credit score and payment history. A strong credit score, typically above 700, coupled with a long history of on-time payments, positions consumers as low-risk clients, giving them leverage when negotiating terms.

Before contacting your lender, it is crucial to conduct a thorough assessment of your current financial situation. Gather information on your payment history, credit score, and any relevant changes in your financial circumstances, such as income increases or improved employment stability. This information serves as the backbone of your negotiation strategy. When reaching out to lenders, timing is essential. It is advisable to make these requests either early in the day or mid-week, as these times may yield better results, as lenders are often less pressured by a high volume of calls.

Below is a sample script that may assist consumers during the negotiation process:

Sample Script:

“Hello, my name is [Your Name], and I have been a loyal customer with [Credit Card Company] for [X years]. I have consistently made my payments on time and have been monitoring my credit score, which has improved to [Your Score]. I would like to explore the possibility of a lower interest rate, as this would greatly assist me in managing my finances more effectively. Can we discuss options available to me?”

When engaging lenders, ensuring politeness and professionalism is crucial. Additionally, consider presenting competitive offers from other card providers as leverage during negotiations. By utilizing these techniques, consumers can potentially secure favorable terms, reducing their overall debt burden and paving the way toward financial freedom.

Uncovering Forgotten Debt Forgiveness Programs

In navigating the complexities of debt management, many individuals overlook the availability of unique debt forgiveness programs tailored for specific circumstances. These programs can provide significant relief, particularly for medical debt, student loans, and those facing financial hardships. Understanding how to effectively utilize these programs is crucial for achieving financial freedom.

To start, it is essential to identify the nature of your debt. For medical debt, many healthcare providers offer financial assistance programs aimed at offsetting expenses for individuals facing economic difficulties. A common first step is to contact the billing department of the healthcare facility directly and inquire about any available assistance programs. Eligibility typically hinges on income levels and financial hardship requirements.

For student loans, there are various forgiveness options available through federal programs. The Public Service Loan Forgiveness (PSLF) program, for instance, is designed for borrowers who work in public service. To apply, one must complete the Employment Certification Form to confirm eligibility and submit it to the loan servicer. Additionally, Income-Driven Repayment (IDR) plans can also lead to forgiveness after a specified number of payments. It is advisable to explore these avenues thoroughly as they can provide substantial relief if qualified.

When applying for these forgiveness programs, it is critical to keep in mind the potential implications on your credit score and overall financial health. While forgiveness can alleviate the burden of debt, there may also be a temporary impact on your credit rating, particularly if the forgiven debts were reported as delinquent. Nonetheless, successfully managing your debt can enhance your financial profile in the long run. Understanding these nuances will better prepare you for utilizing debt forgiveness programs responsibly.

Strategic Payment Hacks to Accelerate Debt Freedom

When it comes to eliminating debt efficiently and effectively, incorporating strategic payment methods can make a significant difference. Two widely endorsed strategies are the avalanche method and the snowball method, each with its unique advantages. The avalanche method prioritizes debts with the highest interest rates first. This not only minimizes the total interest paid over time but also accelerates the path to financial freedom. Conversely, the snowball method focuses on paying off the smallest debts first, which can provide a psychological boost as individuals see their debts disappearing quickly. Choosing between these methods often depends on personal motivation and financial circumstances.

To create a powerful payoff plan, it is essential to prioritize debts effectively. Begin by listing all outstanding debts, including the total amounts owed, interest rates, and minimum monthly payments. This transparency allows for a more informed decision on which payment strategy to implement. By focusing payments on either high-interest debts or small balances, individuals can tailor their approach to align with their goals and financial behavior. Additionally, incorporating a budgeting strategy can help allocate funds efficiently toward debt repayment.

Utilizing tools and apps can enhance accountability and streamline the debt management process. Various applications are available to help track payments, set reminders, and visualize progress. For example, apps like Mint provide budgeting assistance alongside debt tracking capabilities, while others like You Need a Budget (YNAB) offer detailed budgeting methodologies to improve overall financial health. By leveraging these digital tools, individuals can maintain an organized system that fosters commitment to their debt elimination efforts. Consistent monitoring and adjusting of strategies according to changing circumstances also play a critical role in maintaining momentum toward achieving financial freedom.

Shifting Mindsets: Moving Away from Conventional Advice

In today’s financial landscape, conventional wisdom often centers around austerity measures, strict budgeting, and the relentless pursuit of minimum payments. However, this traditional approach can inadvertently hinder individuals from taking decisive action toward achieving financial freedom. To truly unlock the potential for effective debt elimination, it is crucial to adopt a more proactive mindset that embraces unconventional strategies. This shift in perspective can pave the way for financial stability and empowerment.

The psychological aspects of debt management play a significant role in how individuals approach their financial situations. Many people find themselves feeling overwhelmed or discouraged by their debts, which can lead to a cycle of inaction. Shifting one’s mindset involves recognizing that debt is not merely a number but a reflection of choices and priorities. Adopting a proactive attitude means viewing debt as a challenge that can be conquered rather than an insurmountable obstacle. This psychological transformation can be incredibly empowering and rewarding.

Several real-life examples illustrate the power of unconventional debt management strategies. For instance, consider an individual who, instead of focusing solely on reducing expenses, sought additional income through side hustles or freelancing opportunities. This proactive approach not only accelerated debt repayment but also instilled a sense of control and accomplishment. Others have shared their success stories of leveraging community resources, such as local workshops or support groups, which provided them with alternative financial insights and encouragement.

Ultimately, shifting mindsets away from conventional debt management advice toward proactive strategies can enhance one’s ability to navigate financial challenges. By embracing a new perspective, individuals may find themselves not only reducing their debt but also achieving a more profound sense of financial stability and freedom. Motivated by these insights and examples, one can begin to explore their unique path toward effective debt elimination.

Conclusion: Your Action Plan for a Debt-Free 2024

As we conclude this discussion on effective debt elimination strategies, it is essential to recognize the significant steps that can be taken towards achieving financial freedom. Over the course of this blog post, we have explored a variety of insider secrets designed to assist individuals facing financial challenges. These strategies, ranging from creating a comprehensive budget to adopting the avalanche or snowball methods for debt repayment, provide a solid foundation for anyone wishing to eliminate their debts.

Implementing these tactics is not merely a theoretical exercise; it requires a commitment to change and consistent action. The importance of setting achievable financial goals cannot be overstated. As we look towards 2024, envisioning a debt-free future can serve as a powerful motivator, urging individuals to take decisive steps toward altering their financial landscape. Remember, it is crucial to regularly assess your progress and adjust your plans as necessary to stay on track.

For those seeking additional support, various resources are available to aid in your journey toward financial liberation. Online financial planning tools, budgeting apps, and debt counseling services can provide further guidance and support. Books and articles on personal finance may also offer valuable insights that align with your specific needs. We encourage you to explore these options as a means to reinforce the strategies discussed and ensure you do not feel isolated in your efforts.

Finally, we invite you to share your own experiences with debt elimination in the comments section. Our community can benefit greatly from the sharing of personal journeys, challenges, and successes. By coming together and supporting one another, we can create an environment conducive to growth and perseverance as we work toward our collective goal of a debt-free life by 2024.

Leave a Reply